Saudi Arabia will be home to many investment opportunities

Water-related targets in the NTP 2020 and Vision 2030 – focus on expanding the role of the private sector

Through the KSA Vision 2030, the government intends to provide better opportunities for partnerships with the private sector through three initiatives:

- Increasing the percentage of desalinated water production through strategic partners

- Increasing the percentage of treated water through strategic partners

- Increasing the percentage of cities covered with water and sewage services though The National Water Company

Within the water sector in particular, the government is looking to increase the share of desalinated water production coming from strategic partners

(e.g., Independent Water and Power Producers). Also, the government wants to start involving the private sector in wastewater treatment. Additionally, the government is looking to expand the coverage area of the National Water Company (NWC), decreasing the role of the directorates. The Government is also contemplating the privatization of NWC.

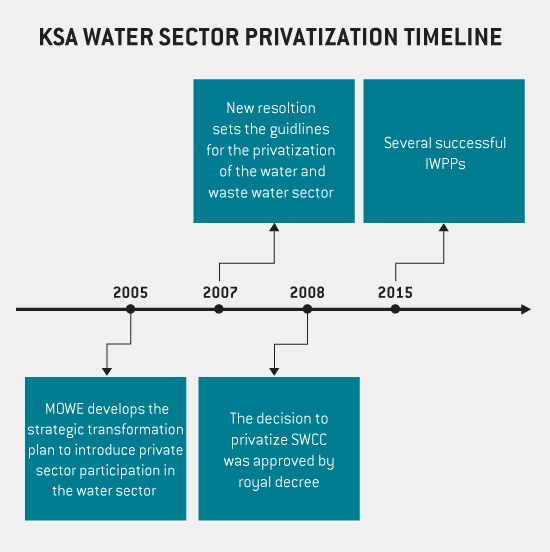

KSA Water sector Privatization

Since early 2000, the private sector has been involved in the water sector, principally in financing, constructing and operating desalination plants. The model has traditionally relied on off-takers that buy from the IWPPs water destined to municipal use. Agreements were based on 20-year power and water purchase agreements (PWPAs) with a full government guarantee for payments.

The first major IWPP, Shoaiba III, was completed in 2005. The plant is located in the Red Sea. It supplies three major cities: Jeddah, Makkah and Taief. The second IWPP was the Jubail II project, located next to the Jubail industrial complex on the Arabian Gulf coast. The project was commission by Marafiq which provides power and water for the industrial city. By 2015 the Kindgom acquired two additional IWPPs, Shuqaiq II and Ras Al-Khair. Ras Al-Khair, which was completed in 2014, is the largest desalination plant in the world.

In 2016, the country announced plans to privatize the state-owned SWCC which holds some SAR80 billion in assets, including around 4.6 million m3/d of seawater desalination capacity, paving the way for increased private sector participation. Privatization will be carried out in two stages: first, investment partners willing to take a stake in production assets will be sought; this will be followed by an IPO on the local exchange “Tadawul”

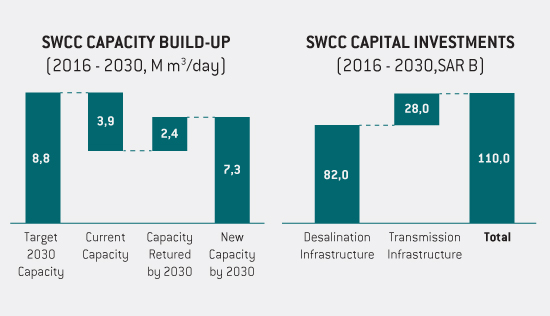

SWCC Capital Investment (2016-2030)

Given the KSA’s ambitious targets, it will be home to many investment opportunities in the water sector.

SWCC plans to build on its current position as the largest producer of desalinated water by more than doubling its capacity by 2030. It is targeting to reach a capacity of 8.8M m3/day of desalinated water by 2030. Coupled with its current capacity of around 3.9M m3/day, and expected decommissioning of facilities producing 2.4M m3/day, SWCC will build up to 7.3M m3/day of new capacity by 2030. In order to reach its target 2030 capacity, SWCC is planning capital investments of up to SAR 110B, the majority of which (SAR 82B) consists of desalination infrastructure, while the rest (SAR 28B) is budgeted for transmission infrastructure.

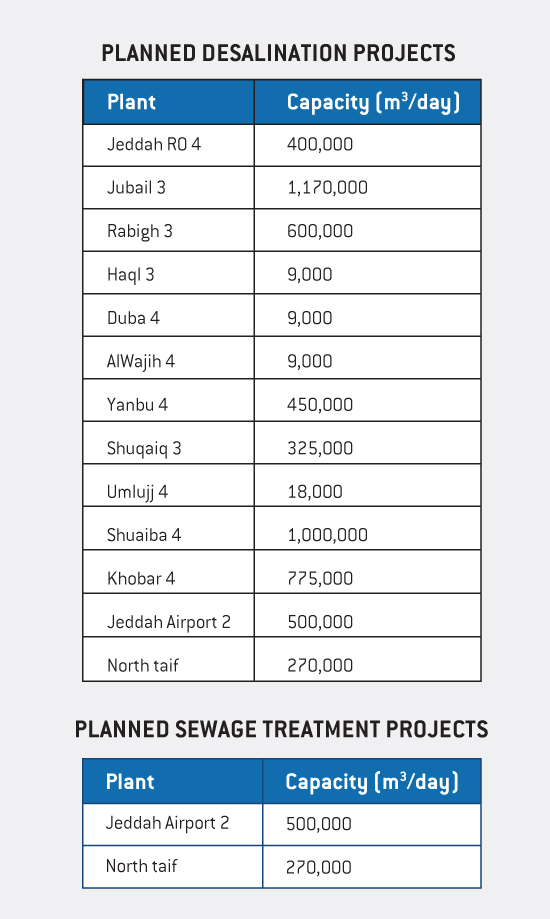

Furthermore, SWCC plans to invest in two more sewage treatment plants with a total capacity of 770,000 m3/day SWCC plans to involve the private sector as much as possible in building up this capacity, signaling the significant potential for investment in the desalination sector in the KSA.